Officials on the frontlines of SNAP benefits administration across the nation are warning Congress about a little-known legislative provision with a huge impact on state budgets – an impact supercharged by the government shutdown. Governors join the coalition in urging congressional action this month to prevent massive SNAP impacts nationwide.

State and county leaders detailed the impacts in a congressional briefing this week organized by a coalition including the National Governors Association (NGA), the American Public Human Services Association (APHSA), the National Association of Counties (NACo), the National Conference of State Legislatures (NCSL), the National Association of County Human Services Administrators (NACHSA), the National League of Cities (NLC), the International County/City Management Association (ICMA), the US Conference of Mayors (USCM), and The Council of State Governments (CSG).

The organizations sent a letter to congressional leadership last week calling for action in a January congressional resolution (CR).

Recent changes to SNAP under the One Big Beautiful Bill Act (H.R. 1/P.L. 119-21) mandate new financial accountability measures tying new state benefit cost-sharing requirements to Payment Error Rates (PER) data collected during 2025 – a period of major policy change, delayed federal guidance, and shutdown-related disruption.

Annual SNAP expenditures could increase an average $218 million per state if PER data collected during the shutdown period is not excluded from future cost-sharing calculations.

“To be clear, states and counties understand and share the goal of strengthening program integrity, reducing errors and improving payment accuracy,” stated Reggie Bicha, APHSA President and CEO told a packed congressional briefing on Tuesday. “States and counties want to be partners with Congress and with USDA in implementing these changes. To that end, states are moving swiftly to get this right. They’re upgrading eligibility systems and investing in new technology; they’re hiring staff and creating dedicated Tiger Teams focused specifically on payment accuracy and quality control; they’re doing deep data analysis to better understand where errors are occurring and redesigning processes to address those issues directly. Where we are hearing real concern is not about accountability; it’s about timing and feasibility.

“What states and counties are asking for is quite simple: a true runway and a fair shot,” Bicha concluded.

Bicha and other panelists detailed a chaotic timeline of delayed, disrupted and conflicting guidance:

- July 4: The effective implementation date of the relevant H.R. 1 provisions – four days after most state budgets were already approved by state legislatures

- October 1 – November 12: Federal government shutdown marked by 43 days of conflicting guidance

- October 31: USDA implementation guidance issued

- November 1: Implementation accountability period begins

It all adds up to instability that actually increases error rates at the very same time new policies apply drastic and lasting consequences for errors.

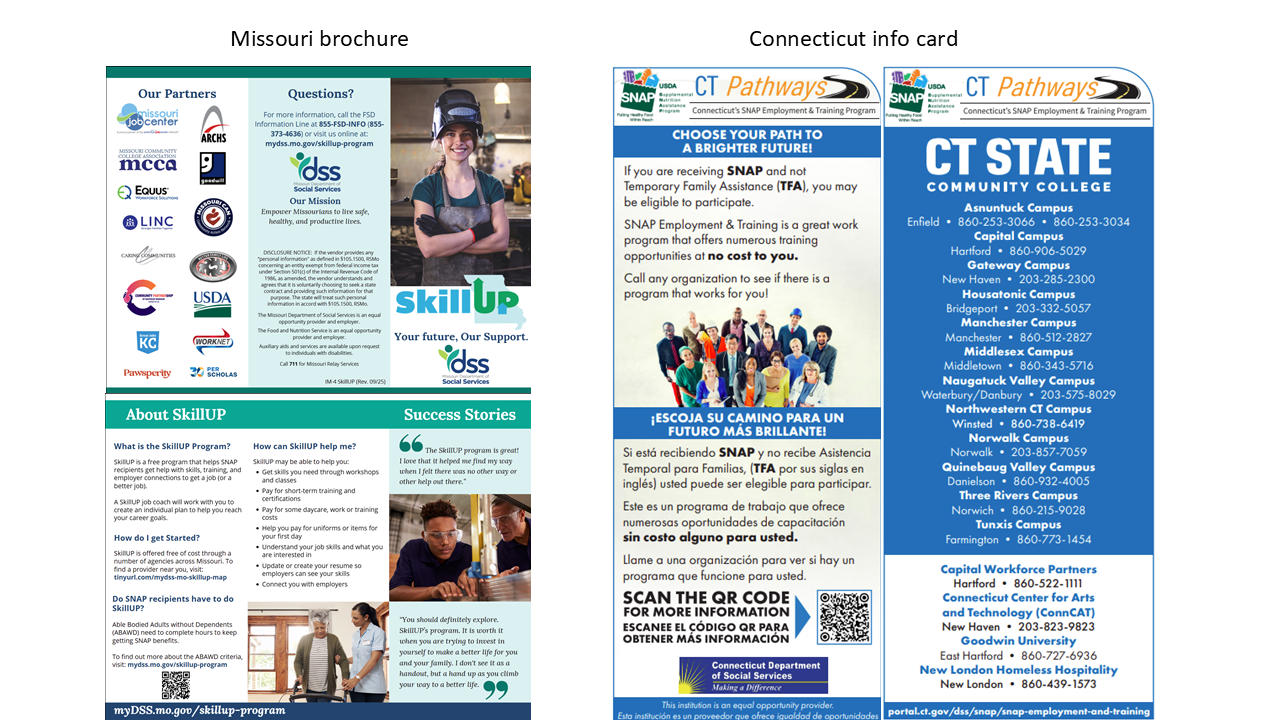

Melissa Wolf, Deputy Director, Intergovernmental Relations, Missouri Department of Social Services; Vice Chair of the American Association of SNAP Directors (AASD), explained how PER is calculated.

“Think of PER as a quality check,” Wolf stated. “It isn’t about fraud or lack of integrity. It’s basically a report card to the state [measuring whether] you calculate benefits correctly. PER is a tool and an opportunity for improvement; we recognize that we need to make improvements, and we want to get this right and set this program up for success. Higher error rates usually signal lack of technology, training and staffing. It’s not about integrity. It’s not about fraud.”

PER captures errors like transposing of numbers, errors in timing of payments and both overpayments and underpayments as low as $57.

Maryland State Delegate Emily Shetty, Chair of Health and Social Services Subcommittee of the Appropriations Committee, noted that Maryland at one point had the largest underpayment rate in the nation. “When people hear error rate, they automatically assume fraud is happening, and people who shouldn’t be getting money are getting money,” she commented. “That’s not what happened.”

Error rates have increased in recent years due to what Wolf described as a “perfect storm” of conditions, including the pandemic, outdated technology used to process benefits, and staffing shortages. Multiple panelists referenced the Great Resignation or “silver tsunami” that has led departments to lose up to 30% of staff and incalculable institutional knowledge.

Adding the shutdown to the mix is a recipe for chaos.

Andrea Barton Reeves, Commissioner, Connecticut Department of Social Services, detailed how the 2025 shutdown was uniquely disruptive – adding to department challenges.

“Our expectation and our intention is to be as compliant with HR 1 as possible,” Barton Reeves stated. “But it takes time to do that. The same people are working on both Medicaid and SNAP. State agencies are very leanly staffed. On top of all of that is the shutdown. The shutdown comes, and there is no guidance. The guidance and what was happening in the courts seemed to change day to day. Every state was trying to pivot with the guidance every single day. We normally get about 200,000 calls a month to our service center from people looking for help. We probably had a 25% increase in the number of calls. It had everything to do with the volatility of the conditions around SNAP.

“This particular shutdown was different,” Barton Reeves continued. “There was a different way in which SNAP benefits were continued; we’re navigating [those changes]; we’re navigating litigation, and we’re also navigating lots of really panicked people who have households who are very vulnerable. The guidance we were receiving from FNS was inconsistent, which made it difficult for us to make solid determinations about our next steps. It was chaotic. It remains challenging.”

Bicha underlined that PER being calculated during this period occurred with a backdrop of the federal government telling states: “Do a partial payment in November; no wait, do a full payment; no wait, we didn’t say to do a full payment.”

Hope Otto, Director, Health and Human Services, Racine County, Wisconsin, agreed that reducing error rates takes time – especially in the context of staffing challenges all states are facing. Wisconsin is unique in that its benefits are administered at the county level, and the state has successfully reduced error rates through tools like automation and centralization through county consortia.

“When I started in county government, the vast majority of employees had been there 10 years or longer. We don’t see that anymore. It takes 6 months to train an eligibility worker, [and we spend] an additional 6 months under an intense QC, to ensure that they are following policy and procedures. That full training is so important – that onramp that we need to ensure program integrity and the low error rate we experience in Wisconsin.”

Senator Paul Rosino, Oklahoma State Senate; Chair, Health & Human Services Committee, shared how the implementation timeline interacts with state budget calendars, creating acute challenges. Given some parts of Oklahoma DHS still use DOS operating systems, upgrading outdated technology alone will take time and funding, he explained.

“When this came down July 1, the (Oklahoma state senate) appropriations chair called me in a panic, basically saying ‘how are we going to do this in the amount of time they’re asking?’” Rosino recalled. “We want to comply, we want to get our error rate down. We know that we can do better, but we, as a legislature, realized we weren’t giving DHS the tools because we didn’t realize what they needed. What we’re now trying to do is figure out what the infrastructure will cost to make sure the agency has the tools they need. We’re talking $5-7 million just for computer and software updates – plus the runway time to do it. Again, we want to comply. We want to do the right thing, and we will. If we had more time, we know we wouldn’t be rushing through this and making more mistakes.”

“I wanted to stress how bipartisan this problem is,” Maryland Delegate Shetty observed. Turning to her Oklahoma counterpart, Shetty noted that their two states have very different political make-ups, but “my talking points, down to the dollar amount impact on our states, are identical [to yours].”

“No state is ready,” Shetty stressed. “Because we have to balance our budgets, when we have to put more money into our cost shift, we have less money for other programs. Food insecurity is a really big problem in our community… We are doing so much to lower our error rate. We went in two years from 35% to 13.6%. Our error rate is also attributed to underpayment, so we are not giving people the full benefit they’re entitled to.”

Noting that Maryland’s cost share obligation will skyrocket from $150 million this year to $412 million in FY27, Shetty concluded, “This is going to pose a huge fiscal crisis for us.”

Beyond the state budget issues, Shetty urged Congress not to lose sight of the human impact. “When I see the number of children who are benefitting from SNAP, who may no longer benefit from SNAP, I get worried” Shetty stated. “These programs are deeply important. We are struggling in Maryland to ensure we do not drop coverage from as many people as we can. These numbers keep me up at night, and no state is ready.”

In a letter to congressional leadership the coalition urged Congress to adopt two simple fixes in the anticipated January Continuing Resolution:

- Delay the SNAP benefit and administrative cost shares for all states until FY 2030, using FY 2027 Quality Control (QC) data.

- Exclude October and November 2025 from the FY 2026 Quality Control (QC) sample and extend hold harmless for H.R. 1-related changes through January 31, 2026.