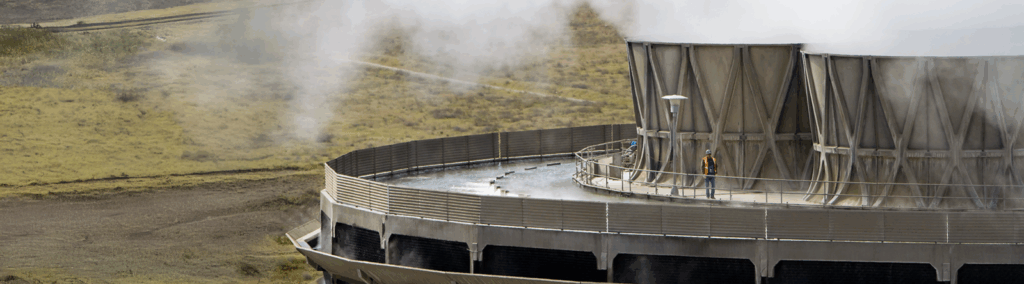

As demand for artificial intelligence (AI) services has grown in recent years, the amount of power they require to continue to grow has also risen. Utilities that are accustomed to close state regulation and extended investment timeframes are working to accommodate the rapid demand for power from the expanding AI industry. This is leading hyperscalers to consider new strategies to deliver energy to their data centers, such as investing in new nuclear technologies, engaging in power purchase agreements (PPAs) for existing nuclear power plants capacity, and efforts to restart recently shuttered nuclear power plants.

(Download)

The growing power demand from data centers has been a frequent topic of discussion in the energy space this year. They are critical to developing artificial intelligence, which promises to have a wide impact on the economy and our lives, and not least it is touted as critical to national security. But these data centers need a lot of uninterrupted and resilient power and water. This demand, plus fluctuations in the power markets used by data centers, have spurred a reevaluation of energy generation sources, and brought nuclear back into the national conversation because it provides long term price stability and 24/7 generation, attributes valued by hyperscalers. This has led to a nuclear renaissance as these firms seek to diversify how they source their power and consider both behind-the-meter and in-front-of-the-meter investments to meet their electricity demand.

An interesting early example of this approach is being utilized by Microsoft, which is engaging in a power purchase agreement with Constellation Energy to restart a reactor at the Crane Clean Energy Center, formerly Three Mile Island, to power a co-located data center. The generating station in question had previously been shuttered because it was unattractive to operate in a prior economic environment, but now in an era of rapidly growing energy demand, the stability of this long-term deal is attractive. Microsoft has agreed to purchase power from the plant for the next twenty years, providing price stability to Microsoft’s adjacent operations, and job security for workers at the plant. This deal will provide Microsoft with 835 MWe for its data center that will be located within the bounds of the site. Google has engaged with NextEra Energy in a very similar deal to buy power from the Duane Arnold Energy Center in Iowa once it has been restarted. It is notable that this deal does not commit Google to restarting the plant, however, this is a strong step towards that outcome. The Duane Arnold plant has been shuttered since 2020, but could be back online as soon as 2027.

Meta has taken a similar tack to Microsoft and Google, inking a deal with Constellation Energy to purchase power from the Clinton Clean Energy Center for 20 years, saving a plant slated for closure. This plant sustained years of losses and initially was set to close in 2017 until state incentives kept the plant competitive. This deal functionally replaces the soon expiring incentives, preserving jobs and tax revenue for the area and the state. Constellation is also considering utilizing this site for future small modular reactor (SMR) development. This is far from the only example of Meta making big investments in power generation, as Meta has struck a deal with Louisiana to build a data center that was touted as a $10 billion investment, later growing to be financed at $27 billion, representing the largest investment in the Richland Parish’s history. Though this data center does not involve direct investment in nuclear energy to power it, the partnership between Meta and Entergy Louisiana to power this data center is notable as a model for collaboration between technology companies and utilities to bring more energy onto the grid.

Meta and Entergy have directly signed a deal to provide over 2 GWe to the site, with Meta paying its share of the costs for the newly needed infrastructure. This project could be an innovative model for future nuclear-powered efforts by hyperscalers that show they can be good neighbors, allaying many of the local concerns that bedevil this buildout.

These examples are likely the current closest projects to fruition, but it is emblematic of a broader trend in the data center industry of investing in new nuclear companies, mostly SMRs with the hope they will one day prove a reliable and replicable form of power generation. Google recently took an interest in new nuclear energy with a purchase agreement with Kairos Power, an innovative SMR startup. This differs significantly from the agreement outlined above, as Kairos currently does not have operating commercial reactors. The deal stipulates that Kairos is to bring their first SMR online in 2030, with additional reactors to follow shortly. Google has also recently partnered with Elementl Power to advance nuclear energy site development. Google will provide early-stage capital to help Elementl prepare three potential sites aiming for 600 MWe of capacity.

Amazon has taken a more diversified approach to developing capacity in the SMR space, entering into several agreements across the nation. This reflects Amazon’s efforts to create a vertical value chain for its lines of business by taking stakes in unproven technologies, which differs from utilities’ generally more cautious approach to investments. Deals of this sort are not common in the power sector, and offer capital for innovation that other business models cannot provide. One Amazon deal, with Energy Northwest, a consortium of state public utilities, calls for the development of four SMRs, with the initial reactor batch to generate 320 MWe, and more capacity to be added as the technology matures. Amazon has even taken a direct stake in X-energy to support a feasibility study of X-energy’s Xe-100s reactors at Hanford with Energy Northwest. Another agreement, with Dominion Energy in Virginia, calls for the exploration of an SMR project located on the site of Dominion’s North Anna nuclear power station bringing another 300 MWe. There is a push and pull relationship between the utilities and hyperscalers currently, as utilities are being encouraged to innovate to meet growing demand, and hyperscalers are being encouraged to lower or delay their demand for more energy. Amazon has even made progress recently on the troubled project with Talen Energy to purchase power from the Susquehanna Nuclear Generation Station as a “front-of-the-meter” arrangement. This deal had been blocked by FERC for its potential impacts on the PJM market. It remains to be seen if the tech sector continues to shape the power sector, but this is very likely if the AI boom continues as slated.

In addition to these AI power deals between major tech companies and nuclear plant owners or SMR developers, agreements have also been signed with microreactor developers. For example, the data center company Equinix announced in August that it had preordered twenty of Radiant’s Kaleidos microreactors to provide transportable, modular, and long-lasting power for data centers.

All this to say, investment in AI is here, and for that to happen the nation will need significantly more power than it currently generates. McKinsey predicts that data centers may triple as a percentage of load by 2030. The large build out of infrastructure to support data center development will require expensive and time-consuming generation and transmission investments. State regulators, already concerned with affordability for customers, may be reluctant to authorize these new investments. Tech companies may likewise be reluctant to navigate the heavily regulated power sector and may instead opt bypass the grid entirely by building power generation on their data center campuses. It is possible, as new nuclear technology develops, for companies to quickly stand-up new power generation facilities to meet their needs, where they need it, making both innovation and the grid more nimble. But time will tell, and many of these technologies are being closely watched as they develop.

The scale of investment in infrastructure to support artificial intelligence is relatively new, and the eventual returns on AI remains to be seen, and what happens to all this investment should these returns be more modest is not known. Data centers for AI are certainly driving the flashiest investments in the energy sector, but it is entirely possible this boom moderates either before the grid is ready for it, or after, leaving stranded assets. Much of the recent interest in new nuclear has been spurred by this demand for power, and innovations in chip efficiency or the market for AI could moderate that demand, and with it interest in nuclear power. One study claims AI will only account for 25% of new demand on the grid by 2030, meaning that if this revolution does not happen, utilities may not be stuck with an asset that is uneconomical should demand for AI evaporate. Electricity demand is slated to rise regardless of the AI boom due to increasing home and transportation electrification, potential onshoring of manufacturing, and general economic and population growth. This means that these investments may still pay off in a more moderate AI future, which may require another wave of innovation to integrate these assets into the grid.