Electricity Markets – 101

How electricity markets are structured, including who oversees the generation, transmission, and distribution of electricity varies across the U.S. Many electric utility roles have changed in states over the past 20 to 25 years.

This site is meant to provide an overview of the differences within each U.S. electricity market and assist Governor’s and their staff when assessing how their policies may impact those markets. Topics covered include the difference between vertically integrated and restructured electricity markets, the role of Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs), and the different types of electricity financial markets such as day-ahead vs. real-time, capacity, and ancillary services markets.

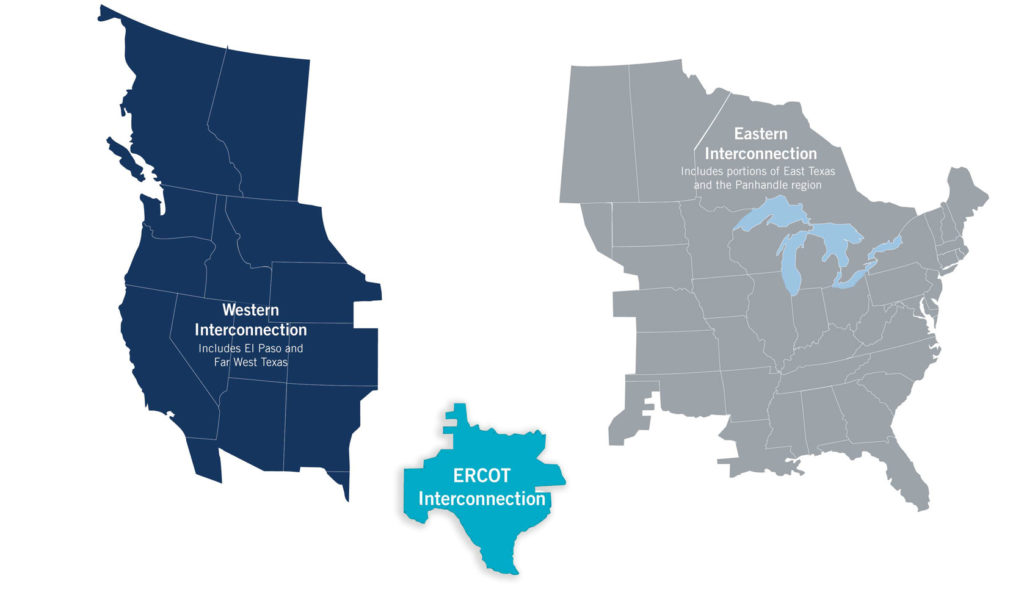

North American Power Grid

In the United States, local electricity grids are connected to form larger networks and improve reliability and economic efficiency. The U.S. electricity system has three main interconnections – the Eastern Interconnection, Western Interconnection, and the Electric Reliability Council of Texas (ERCOT). These three interconnections operate independently of each other and have very limited transfers of power between them.

The operation of the electric system is conducted by balancing authorities, which ensures that power supply and demand are balanced to maintain reliability of the power system. Balancing authorities do this by controlling the generation and transmission of electricity throughout their own regions and between neighboring regions. All RTOs and ISOs in the U.S. are balancing authorities, and some electric utilities also serve in this role. The Eastern Interconnection has 36 balancing authorities, and the Western Interconnection has 37.

Glossary

- Ancillary services

- Bilateral transactions

- Bulk Electric System

- Capacity market

- Day Ahead Market

- Distribution

- Federal Energy Regulatory Commission (FERC)

- Generation

- Independent System Operator

- Locational Marginal Pricing

- Power Marketing Agencies

- Power Pools

- Rate Base

- Real-time Market

- Regional Transmission Operator

- Reserve Margin

- Restructured Markets

- Retail Choice

- Retail Markets

- Transmission

- Transmission Congestion Contracts

- Vertically Integrated Energy Markets

- Western Energy Imbalance Market (EIM)

- Wholesale Markets

Electricity Market Webinars

NGA held a three-part series on electricity markets. You can watch and access the slides from the webinar at the links below, or watch the playlist.

Electricity Markets 201: Federal and State Authorities

Electricity Market Structures – Questions & Answers

What is the difference between vertically integrated and restructured electricity markets?

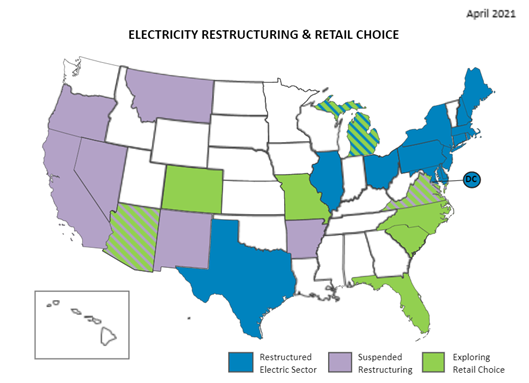

State electricity markets have traditionally been vertically integrated where the utility may own or oversee the generation, transmission, and delivery of electricity to customers. This structure evolved as electrification spread in the early parts of the last century because the provision of electric service was deemed a natural monopoly. In the late 1990’s/early 2000’s, some states began the process of restructuring their energy markets (retail electricity and sometimes natural gas) to increase competition in the generation of electricity. States that restructured required electric utilities to sell their generation assets while the transmission and distribution system remained under their ownership. Thirteen states have fully restructured their retail electricity markets, and in some instances allow consumers to decide from whom to purchase electricity called “retail choice.” Six states suspended restructuring whereas eight others are exploring retail choice options. Some states, like California, have partially restructured markets and only permit certain consumers to engage in retail choice. A map from the Edison Electric Institute of state’s that restructured and key differences between vertically integrated and restructured markets is below.

- Under this structure, utilities are responsible for the generation, distribution and transmission of power to customers. Utilities typically own all or some of the generation assets, distribution lines, as well as some of the transmission lines needed to serve customers. In addition to generating electricity, they also purchase some power through contracts from independent energy suppliers.

- Consumers purchase electricity from the utility that services their area, which has an obligation to serve all customers in that area.

- Utilities must seek approval for energy investments from state commissions, which also oversees the rate of return on utility investments and determines the rates that customers pay.

- Wholesale energy prices are set by the ISO and RTO markets with some federal oversight of these markets. Importantly, state commissions still determine the rates that retail customers pay and still provide oversight of the distribution utility that delivers power to customers.

- In most restructured states, customers are offered the ability to choose the supplier of their electricity.

- In most states, distribution utilities own and operate the distribution system and some portion of the transmission system. They must still serve as the provider of last resort for customers who do not choose an alternate provider of electricity. However, these distribution utilities cannot own their generation assets and must either acquire power from the wholesale markets or from independent energy suppliers under power purchase agreements.

- RTOs and ISOs manage wholesale electricity markets and oversee grid operations.

What are the differences between wholesale and retail electricity markets and how are they regulated?

U.S. electricity markets have wholesale and retail components. Wholesale markets involve the sale of electricity among generators and resellers, which will then be sold to consumers. Retail markets involve the sale of electricity directly to consumers. Wholesale and retail markets can be found in traditionally regulated states or restructured states.

Wholesale Markets

Wholesale electricity markets can be found in both traditionally regulated states or in restructured markets such as in the Northeast, Midwest, Texas and California. ISOs and RTOs, described below, run competitive markets allowing for independent power producers and non-utility generators to sell their power.

Retail Markets

Retail markets and how they’re regulated are determined at the state level and can be found in traditionally regulated or restructured markets. In a vertically integrated state, consumers purchase power from the utility that serves their area. Most vertically integrated retail markets are found in the Southeast, Northwest, and much of the West. Competitive retail markets give customers the option to choose their retail electricity supplier.

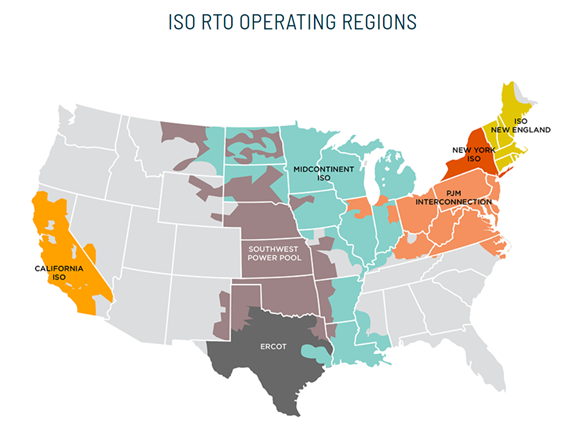

What are Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs)?

RTOs and ISOs operate in states with wholesale electricity markets. The terms RTO and ISO are often used interchangeably, and both oversee operation of regional transmission systems. ISOs/RTOs allow independent power producers and non-utility generators to trade power under the supervision of federal regulators.

There are currently seven ISOs/RTOs that operate in the contiguous United States:

- California ISO (CAISO) –covers most of California and a small part of Nevada. It imports about one-third of its energy from the Pacific Northwest and the Southwestern United States.

- Electric Reliability Council of Texas (ERCOT) –covers most of Texas.

- Midcontinent ISO (MISO) – operates in portions of 15 states in the Midwest and the South.

- New York ISO (NYISO) –covers the state of New York

- New England ISO (NE-ISO) –includes all of Vermont, New Hampshire, Massachusetts, Connecticut Rhode Island, and most of Maine.

- PJM Interconnection (PJM) – includes portions of 13 states in the Midwest, Mid-Atlantic or Northeast.

- Southwest Power Pool (SPP) – operates in portions of 14 states in the Great Plains states and parts of the South and West.

What are the types of electricity financial markets that operate in ISOs/RTOs?

Most RTOs/ISOs operate day-ahead and real-time energy markets, and ancillary services markets. Some, but not all, also operate capacity markets. These different markets are described below:

- Day-ahead: 95 percent of market transactions, sales and purchase of electricity are based on the next day’s forecasted load (demand for electricity). The day-ahead market allows purchasers to hedge against price fluctuations that can occur in real time. RTOs that operate day-ahead markets include PJM, SPP, ISO-NE and ERCOT.

- Real-time: Sales and purchase of electricity to meet the real-time demand for electricity withing the ISO/RTO. Prices can vary from minute to minute; the real-time market accounts for any differences between the day-ahead schedule and actual demand and supply changes. RTOs that operate real-time markets include PJM, SPP, and ERCOT.

- Energy Imbalance Markets: is a voluntary real-time market; SPP and CAISO both operate energy imbalance markets.

- EIMs do not require a participating utility to join an RTO. Utilities are typically vertically integrated. These can also leverage neighboring RTO’s existing platforms to allow limited, voluntary, real-time energy trades without being RTO members.

- Ancillary services market: This market is for services that are necessary to maintain transmission system operation and provide reliability support. Ancillary services include voltage control and support, reactive power, frequency control, spinning reserves, and standby power. These ancillary services are provided by generators in vertically integrated states, but must be separately procured in all of the ISOs/RTOs.

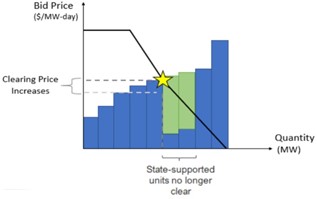

- Capacity market: This market helps ensure grid reliability standards are met by selecting power plants to meet peak electricity demand at a future date, which in some RTOs may be three years in the future. In capacity markets, the grid operator (ISO/RTO) commonly holds an auction based on projections for electricity demand in three years. Generators set bid prices equal to the cost required to operate their plant, bids are arranged from low to high, then the ISO/RTO will accept bids up to the amount of electricity needed to meet demand. Once that is met, the market clears, and generator’s bids are selected. Energy generators that cleared then receive the same price, which comes from the highest-bidding selected generator. These payments help cover some fixed costs, but capacity markets are mainly intended to secure reliability in a competitive manner. RTOs that use capacity markets include MISO, NYISO, PJM and ISO-NE.

Other Key Market Purposes and Tools

- Resource Adequacy: is the ability of the electricity system to meet electricity demand at all times. RTOs may meet reliability standards through resource adequacy and operational reliability requirements. CAISO and SPP require resource adequacy standards to meet load obligations, whereas other RTOs may have resource adequacy standards to augment reliability metrics from capacity markets.

- Transmission Congestion Costs: When transmission capacity for selecting all least-cost generators is insufficient, congestion occurs. To overcome these issues, RTOs utilize financial transmission rights (FTRs), which protects customers against the risk of congestion driven price increases in the day-ahead market in RTOs. FTRs protect customers from transmission congestion costs associated with a specific transmission path on the grid. FTRs are used in all six FERC jurisdictional RTOs: ISO-NE, NYISO, CAISO, MISO, PJM, and SPP; along with ERCOT.

Electricity Markets Timeline

Market Jurisdictions – Questions & Answers

What types of electricity markets do each ISO/RTO operate?

- Operates day-ahead, and real-time markets, ancillary services, and congestion revenue rights along with convergence bidding activities.

- CAISO does not have a formal capacity market, but it does have a mandatory resource adequacy requirement.

- Ancillary services offered include regulation, spinning and non-spinning reserves.

- Operates the Energy Imbalance Market (EIM), a real-time voluntary market, which operates in an 8-state region in the west.

- Operates day-ahead and real-time, ancillary service, and congestion revenue rights markets.

- It does not run a capacity market, but instead relies on price signals in the energy markets to address reliability requirements.

- The RTO features an operating reserve demand curve designed to ensure reliability and sufficient reserves.

- Operates day-ahead and real-time energy markets, forward capacity markets, and ancillary services.

- Transmission congestion costs are offset by annual or monthly financial transmission rights (FTRs)

- The ancillary services offered include ten-minute spinning reserves, ten-minute supplemental reserves, thirty-minute supplemental reserves, and regulation.

- Forward Capacity Market holds auctions annually, 3 years in advance of the operating period.

- Operates day-ahead and real-time markets, capacity market, and ancillary services.

- Transmission congestion costs are addressed through an auction for FTRs.

- The ancillary services offered include spinning reserves, supplemental reserves, and regulation.

- The capacity market is on an annual basis for generators to meet the load forecast plus reserve needs.

- Operates day-ahead and real-time markets, capacity market, and ancillary services.

- The ISO’s capacity market covers three different durations, capability period (six months), monthly auction, and the spot market auction.

- It also addresses transmission congestion through instruments called transmission congestion contracts.

- Operates day-ahead and real-time markets, capacity markets, and ancillary services.

- Transmission congestion costs are offset by financial transmission rights.

- PJM’s capacity market is called the Reliability Pricing Model and is based on three-year, forward-looking annual obligations for locational capacity needs.

- The ancillary services offered are the Synchronized Reserve Market, the Non-Synchronized Reserve Market, the Day-Ahead Scheduling Reserve Market and the Regulation Market.

- Began operating its energy imbalance market in 2007, which transitioned to the Western Energy Imbalance Services (WEIS) market, balancing generation and load in real-time for participants in the Western Interconnection beginning in 2021.

- Operates day-ahead market, real-time market, ancillary services and operating reserve markets since 2014.

- It also addresses transmission congestion through instruments called transmission congestion rights.

What authorities do states have over electricity markets?

States maintain certain authorities over electricity markets, primarily overseeing retail electricity rates and distribution service. These authorities can vary in vertically integrated and restructured states. In vertically integrated states, regulators set utility rates at just and reasonable prices, ensure consumer protections, and balance utility cost recovery for new investments. In restructured states, regulations are enforced on the distribution side. Generators in these states compete in energy markets to serve customers and are out of state regulatory purview.

State regulators adopt policies to set prices and terms of service for investor-owned utilities, as well as cooperative and municipal utilities in certain states. Regulators review utility capital investment planning and retail electricity rates for different customer classes. States also have authority over siting and permitting of power production facilities, outside of nuclear or hydropower facilities. Finally, some states in RTO/ISO territories have kept resource adequacy responsibilities, instead of requiring the RTO/ISO to enforce.

Outside of regulation, states can set energy policies such as requiring a certain percentage of retail electricity sales in the state to come from renewable generation under a renewable portfolio standards (RPS), or can set energy efficiency resource standards (EERS) or clean energy standards (CES). These policies incorporate tools that affect generation capacity as well as pricing in electricity markets, with financial incentives such as renewable energy credits (RECs) or Zero Emission Credits (ZECs) creating more demand for certain types of cleaner generation such as renewables, energy storage, and nuclear.

Finally, while ISO/RTO membership has been static for nearly two decades, some states are exploring whether to join RTOs/ISOs. For example, Colorado signed legislation, SB 72, requiring the state to consider joining an RTO by 2030. Joining an RTO/ISO provides the market signals to advance transmission buildout to deliver renewable generation to population centers, and can help Western states address electricity reliability challenges from climate change. Nevada additionally signed similar legislation to consider joining an RTO within the same time frame as Colorado.

What authorities do federal agencies have over electricity markets?

The Federal Energy Regulatory Commission (FERC) regulates interstate transmission and wholesale power sales. the U.S. Environmental Protection Agency (EPA) and other agencies such as the Department of the Interior (DOI) also issue regulations impacting the energy sector. For example, the EPA regulates air pollutant emissions from power plants and other sources of emissions like mercury and smog forming pollutants (NOx, and SOx) and regulates greenhouse gas emissions from certain types of new fossil fuel-based generators. The DOI oversees some aspects of the permitting and siting of generation and transmission lines that cross federal lands, including potential impacts on threatened and endangered species and issues leases for offshore wind projects along the East coast. The Department of Energy helps accelerate technology development and deployment by providing funding for new technologies such as nuclear energy, renewable energy, energy storage, as well as electric and alternative fuel vehicle technologies.

How can Governors and their Offices play a role in electricity markets?

While state and federal regulators oversee the various electricity markets, Governors still have a role to play. As mentioned previously, setting energy policies can have a clear impact on both generation resource makeup as well as electricity prices. Governors have established energy policy priorities in their states through executive action, such as calling for carbon neutrality in North Dakota or setting electric vehicle targets in New Jersey. Governors may also appoint state regulators, which occurs in 35 states. These selections and related policies all shape energy demand, generation resources, and electric prices.

Governors have also joined regional collaboratives such as the Regional Greenhouse Gas Initiative (RGGI) or the Zero Emission Vehicle program. RGGI may be most pertinent to electricity markets as it sets a cap on power sector emission from participating states in 10 New England and Mid-Atlantic states. Power plants in the region must acquire carbon dioxide allowances from each states allowance budget, then may trade allowances based on market efficiencies.

Finally, Governors also may influence regional grid operators. For example, in the California ISO, the Governor appoints members to the board of the grid operator. This process is unique as most other RTOs or ISOs are independently governed.

Case Study on Federal & State Policy Interaction

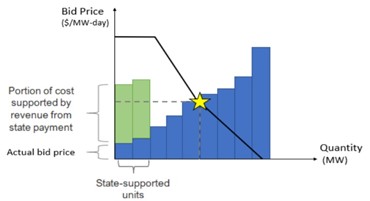

FERC orders and state energy goals overlap in various ways. One recent example involves how Maryland was affected by FERC’s minimum offer price rule (MOPR) from late 2019. For background, the MOPR impacted PJM’s service territory, a grid operator servicing Maryland as well as 13 mid-Atlantic and Midwest states and DC. The rule required any resources receiving “out-of-market” payments, typically state subsidies, or credits, not to account for these incentive payments when bidding into PJM’s capacity market. Renewable resources would need to bid into PJM’s market at a higher, default price than they would have if they could account for various federal and state incentives. The default prices all exceeded the average market clearing prices, reducing the chance for these clean resources to clear the capacity market and receive capacity payments.

The MOPR was expected to alter the ability of Maryland to meet its state energy goals. The state has a requirement to get 50 percent of its energy supply from renewable energy by 2030. The MOPR would have likely increased energy prices for the state, due to minimized ability for renewable resources to capture capacity payments and offset cost increases. The state worked with the Brattle Group, a consulting firm, to identify two ways that customers would pay extra. First, customers would make higher payments to bring clean energy online and supplement missed revenues from generators not being able to participate in the PJM capacity market. Second, there would be higher capacity clearing prices due to more expensive resources clearing the capacity auction. This process can be observed in the above charts, from Exelon, detailing which resources meet the clearing prices and how that shifts with a potential MOPR. While the MOPR was ultimately not implemented, it caused concern for Maryland in its ability to meet clean energy goals through wholesale energy markets.

Electricity Markets Glossary

- Ancillary services – those services necessary to support the transmission of electric power from seller to purchaser given the obligations of control areas and transmitting utilities within those control areas to maintain reliable operations of the interconnected transmission system. Such functions may help grid operators maintain a reliable electricity system by maintaining proper electricity flow, addressing demand imbalances, and recovering after an energy blackout. Further services may include:

- Regulation – used to control small mismatches between load and generation, and adjusts for small tips to either side of the scale.

- Reserves – recovers system balance by making up for generation deficiencies if there is loss of a large generator.

- Spinning reserves – reserves are already online and synchronized, versus nonspinning which are not.

- Bilateral transactions – a transaction between two willing parties who enter into a physical or financial agreement to trade energy commodities.

- Bulk Electric System – refers to “the electrical generation resources, transmission lines, interconnections with neighboring systems, and associated equipment, generally operated at high voltages.”

- Capacity market – markets used to pay grid operators to recover fixed costs for being available to meet peak electricity demand and ensuring grid reliability. Electricity is bid into the market and will be called upon at a certain interval later, often a few years into the future. Generators bid into the market through an auction by setting their price at the cost required to operate. Then all bids are “cleared” from lowest to highest prices until peak demand is met. (2)

- Day ahead market – this market represents around 95 percent of energy transactions and based on forecasted load for the next day and typically occurs the prior morning in order to allow generators to prepare for operation. (2)

- Distribution – the delivery of electricity to retail customers primarily through low-voltage power lines. (1)

- Generation – any equipment or device that supplies energy to the electric system, typical sources include nuclear, coal, gas, renewable energy, geothermal, hydropower, among others. (1)

- Independent System Operator – an independent, federally regulated entity which coordinates regional transmission in a non-discriminatory manner to ensure the safety and reliability of the electricity system. (1)

- Locational marginal pricing – Allows for wholesale prices to reflect the value of electric energy at different locations, by accounting for patterns of load, generation, and physical limits on transmission.

- Power Marketing Agencies – Federal agencies that were created by Congress to market power produced by federal dams. These agencies include Bonneville Power Administration, Southeastern Power Administration, Southwestern Power Administration, and the Western Area Power Administration. Tennessee Valley Authority is not a PMA but is similar operationally. PMAs sell power at wholesale level to local, vertically integrated utilities or local distribution utilities. (1)

- Power pools – an association of two or more interconnected electric systems having an agreement to coordinate operations and planning for improved reliability and efficiencies.

- Rate base – net investment of a utility in property that is used to serve the public. This includes the original cost net of depreciation, adjusted by working capital, deferred taxes, and various regulatory assets. The term is often misused to describe the utility revenue requirement. (1)

- Real-time market – this market balances the differences between the day-ahead scheduled amounts of electricity based on day-ahead forecast and the actual real-time load. (2)

- Regional Transmission Operator – is a transmission operator that coordinates, controls and monitors an electric grid, and regulated by FERC. It is similar to an ISO and are often referred to interchangeably. (1)

- Reserve margin – the amount of energy supply capacity that must be able to supply, beyond the required demand to assure reliability when generation or transmission resources are offline. (1)

- Restructured markets – refers to the replacement of vertically integrated utilities with a competitive market, most often where utilities no longer own the generation assets and operates in a wholesale electricity market. Some cases involve retail customers choosing their generation suppliers directly. (1)

- Retail Choice – a restructured market in which customers are allowed to or must choose their own competitive supplier of generation and transmission services. In most states with retail choice, the incumbent utility or some other identified entity is designated as a default service provider for customers who, through inaction, do not choose another supplier. (1)

- Retail markets – these markets involve the energy purchases and sales between resellers and retail customers, such as residential or commercial energy users.

- The Federal Energy Regulatory Commission (FERC) – FERC is an independent agency responsible for the regulation of interstate transmission of natural gas, oil, and electricity. (2)

- Transmission – the electric system which carries energy in bulk, which is typically done at high voltage levels and connects generation to local distribution facilities. (1)

- Vertically integrated energy markets – where a single company owns the generation, transmission, distribution, and delivers electricity to end users. (1)

- Transmission Congestion Contracts – an instrument that entitles the holder to a payment for costs that arise with transmission congestion over a selected path, or source-and-sink pair of locations on the grid.

- Western Energy Imbalance Market (EIM) – the EIM is a voluntary, real-time energy market that centrally dispatches generation and coordinates the movement of wholesale electricity. It is not an RTO, but instead dispatches generation economically every five minutes and balances supply and demand across its large region. It enables exchange of excess generation from one region to address high cost or generation shortage elsewhere.

- Wholesale markets – these are competitive energy markets where energy is bought and sold between generators and resellers. (2)

Additional Sources:

- RAP: Electricity Regulation In the US: A Guide

- FERC – Energy Primer

- Resources For the Future – US Electricity Markets 101

In the 1880s, Thomas Edison was the first to provide electricity to a wide area, focusing on a neighborhood in New York City. This began the process of providing electricity to large areas, which in turn developed economies of scale. As more people were served, costs were spread out among the customers to pay for electrical infrastructure.

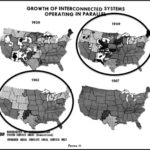

In the 1880s, Thomas Edison was the first to provide electricity to a wide area, focusing on a neighborhood in New York City. This began the process of providing electricity to large areas, which in turn developed economies of scale. As more people were served, costs were spread out among the customers to pay for electrical infrastructure. Between the 1920s and the 1970s power plants and lines were built to supply electricity and were typically vertically integrated – meaning the utility owned the generation, transmission, and distribution. A key to keeping electricity rates low was due to utilities sharing reserve margins with others. In the case of outages, generators had to ensure reliable backup power and sharing those reserves with neighboring utilities through interconnections or power pools cut costs significantly. Power pools formed during this time included PJM, New York, New England, ERCOT, and SPP.

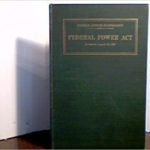

Between the 1920s and the 1970s power plants and lines were built to supply electricity and were typically vertically integrated – meaning the utility owned the generation, transmission, and distribution. A key to keeping electricity rates low was due to utilities sharing reserve margins with others. In the case of outages, generators had to ensure reliable backup power and sharing those reserves with neighboring utilities through interconnections or power pools cut costs significantly. Power pools formed during this time included PJM, New York, New England, ERCOT, and SPP. The Federal Power Act first delineated federal and state jurisdictions for wholesale and retail sales. It eventually enabled the Federal Energy Regulatory Commission (FERC) to have regulatory authority.

The Federal Power Act first delineated federal and state jurisdictions for wholesale and retail sales. It eventually enabled the Federal Energy Regulatory Commission (FERC) to have regulatory authority. The North American Power Systems Interconnection Committee became the informal and voluntary organization to coordinate the bulk power system.

The North American Power Systems Interconnection Committee became the informal and voluntary organization to coordinate the bulk power system. The National Electric Reliability Corporation (NERC) is established after a major blackout. NERC was formed as a nonprofit regulatory authority for North America, with a mission to assure an effective, efficient, and secure grid.

The National Electric Reliability Corporation (NERC) is established after a major blackout. NERC was formed as a nonprofit regulatory authority for North America, with a mission to assure an effective, efficient, and secure grid. FERC is formed as an independent agency with regulatory authorities granted by the Federal Power Act, which was established in 1935. While it has many tasks, a key focus is the regulation of transmission and wholesale electricity sales in interstate commerce.

FERC is formed as an independent agency with regulatory authorities granted by the Federal Power Act, which was established in 1935. While it has many tasks, a key focus is the regulation of transmission and wholesale electricity sales in interstate commerce.  The Public Utility Regulatory Policies Act (PURPA) was enacted in response to the oil crisis and high prices in the 1970s. It focused on encouraging cogeneration, integrating renewable resources, increasing generation competition, and conserving electricity. It has been revised at multiple points and will reappear on the timeline.

The Public Utility Regulatory Policies Act (PURPA) was enacted in response to the oil crisis and high prices in the 1970s. It focused on encouraging cogeneration, integrating renewable resources, increasing generation competition, and conserving electricity. It has been revised at multiple points and will reappear on the timeline. The Energy Policy Act gave FERC authority to allow open transmission access.

The Energy Policy Act gave FERC authority to allow open transmission access. FERC Order 888 required mandatory open transmission access to all users, which filled in the patchwork left by the Energy Policy Act from 4 years earlier. Additionally, it promoted the concept of independent system operators (ISOs) to build competition for wholesale market participants. It left FERC with jurisdiction over wholesale electric sales, transmission, and left state commissions with jurisdiction over distribution and generation components of retail service.

FERC Order 888 required mandatory open transmission access to all users, which filled in the patchwork left by the Energy Policy Act from 4 years earlier. Additionally, it promoted the concept of independent system operators (ISOs) to build competition for wholesale market participants. It left FERC with jurisdiction over wholesale electric sales, transmission, and left state commissions with jurisdiction over distribution and generation components of retail service. FERC Order 2000 encouraged utilities to join regional transmission organizations (RTO). While not mandatory, the emergence of RTOs led to a shift away from utility owned generation as nearly half of electricity generation in the U.S. is owned by non-utilities. This process of restructuring, meant that electric utilities no longer had natural monopolies across all of generation, distribution, and transmission, and introduced competition into certain electric generation markets.

FERC Order 2000 encouraged utilities to join regional transmission organizations (RTO). While not mandatory, the emergence of RTOs led to a shift away from utility owned generation as nearly half of electricity generation in the U.S. is owned by non-utilities. This process of restructuring, meant that electric utilities no longer had natural monopolies across all of generation, distribution, and transmission, and introduced competition into certain electric generation markets. The Energy Policy Act strengthened frameworks for competitive wholesale markets. It allowed the use of eminent domain for acquiring electric transmission rights-of-way in areas designated as congested by the Secretary of Energy. It repealed a PURPA requirement that had required utilities to purchase power from qualifying facilities and small power producers at a rate based on the utilities’ avoided cost, if there were competitive electricity markets available. Finally, FERC is tasked to prohibit any price manipulation in wholesale transactions, in response to the Western energy crisis which revealed market deficiencies.

The Energy Policy Act strengthened frameworks for competitive wholesale markets. It allowed the use of eminent domain for acquiring electric transmission rights-of-way in areas designated as congested by the Secretary of Energy. It repealed a PURPA requirement that had required utilities to purchase power from qualifying facilities and small power producers at a rate based on the utilities’ avoided cost, if there were competitive electricity markets available. Finally, FERC is tasked to prohibit any price manipulation in wholesale transactions, in response to the Western energy crisis which revealed market deficiencies. FERC Order 890 reformed its open access transmission rules to promote transmission service is provided on a just and reasonable basis, as well as provide more transparency in grid operation.

FERC Order 890 reformed its open access transmission rules to promote transmission service is provided on a just and reasonable basis, as well as provide more transparency in grid operation. FERC Order 719 eliminated barriers to demand response in organized energy markets and treat it comparably to other resources.

FERC Order 719 eliminated barriers to demand response in organized energy markets and treat it comparably to other resources. The American Recovery and Reinvestment Act allocated $14 billion for electric power transmission grid development, $14.1 billion for renewable energy tax incentives and $1.4 billion for state and local government energy bonds.

The American Recovery and Reinvestment Act allocated $14 billion for electric power transmission grid development, $14.1 billion for renewable energy tax incentives and $1.4 billion for state and local government energy bonds. FERC Order 745 required RTOs and ISOs to pay demand respond resources the market price for energy when it’s used to balance demands as a replacement for new generation. FERC Order 1000 provided a new framework for planning large-scale transmission projects, with a focus on renewables projects. It increased participation in regional transmission planning, expanding planning from a sole company.

FERC Order 745 required RTOs and ISOs to pay demand respond resources the market price for energy when it’s used to balance demands as a replacement for new generation. FERC Order 1000 provided a new framework for planning large-scale transmission projects, with a focus on renewables projects. It increased participation in regional transmission planning, expanding planning from a sole company. Superstorm Sandy battered much of the Northeast, leaving 8.5 million people in 21 states without power. This prompted a focus on improving critical energy infrastructure and energy resilience.

Superstorm Sandy battered much of the Northeast, leaving 8.5 million people in 21 states without power. This prompted a focus on improving critical energy infrastructure and energy resilience. FERC expanded the controversial Minimum Offer Price Rule which established predetermined prices for renewables if they received revenues from state programs. In turn, it assisted baseload resources like coal and nuclear power to compete in capacity markets. This order was later rescinded after a change in FERC leadership.

FERC expanded the controversial Minimum Offer Price Rule which established predetermined prices for renewables if they received revenues from state programs. In turn, it assisted baseload resources like coal and nuclear power to compete in capacity markets. This order was later rescinded after a change in FERC leadership. FERC Order 2222 aimed to remove barriers for distributed energy resources (DER) to compete in capacity, energy and ancillary services markets. Specifically, it allows for DERs to aggregate resources to satisfy minimum size requirements. FERC Order 841 intends to remove barriers to distributed and behind-the-meter energy storage participation in electricity markets. The Energy Policy Act of 2020 was passed as part of the omnibus bill with a broad update to the nation’s energy policies. It directs the Department of Energy coordinate with stakeholders on grid modeling and integrated energy systems plans, as well as assist those to develop electricity distribution plans through resource assessments and demand analysis.

FERC Order 2222 aimed to remove barriers for distributed energy resources (DER) to compete in capacity, energy and ancillary services markets. Specifically, it allows for DERs to aggregate resources to satisfy minimum size requirements. FERC Order 841 intends to remove barriers to distributed and behind-the-meter energy storage participation in electricity markets. The Energy Policy Act of 2020 was passed as part of the omnibus bill with a broad update to the nation’s energy policies. It directs the Department of Energy coordinate with stakeholders on grid modeling and integrated energy systems plans, as well as assist those to develop electricity distribution plans through resource assessments and demand analysis. FERC announced an Advance Notice of Proposed Rulemaking to plan for interregional transmission planning to accommodate for increased distributed energy resources. This process will seek input on transmission planning, shifting energy loads, and new cost allocations. The Bipartisan Infrastructure Framework (if passed) calls for $73 billion in spending for electric grid infrastructure projects. Of note, it directs DOE to study capacity constraints when designating National Interest Electric Transmission Corridors, requires state regulators to consider rate mechanisms to allow utility cost recovery for demand response.

FERC announced an Advance Notice of Proposed Rulemaking to plan for interregional transmission planning to accommodate for increased distributed energy resources. This process will seek input on transmission planning, shifting energy loads, and new cost allocations. The Bipartisan Infrastructure Framework (if passed) calls for $73 billion in spending for electric grid infrastructure projects. Of note, it directs DOE to study capacity constraints when designating National Interest Electric Transmission Corridors, requires state regulators to consider rate mechanisms to allow utility cost recovery for demand response.