COVID-19 will have long-tail effects that continue to change the U.S. economy and present challenges to states. Governors are learning and working together to address these issues, as well as today’s other pressing public policy challenges.

(Download)

Even as the COVID-19 public health crisis lessens and the country increasingly focuses on a full “return to normal,” the pandemic’s legacy is likely to be profound and will present Governors with lasting challenges that are just being revealed. These challenges that will impact almost every policy area, from budget to healthcare, to infrastructure, to workforce development and education investments. While many post-COVID developments are still in flux, key issues are emerging that are either generated by or exacerbated by the impact of the pandemic, and that Governors should consider incorporating into their policy agendas and longer-term planning, including:

- Ongoing health effects

- Difficulties (re)building workforces in key sectors

- Increase in remote work

- New inflationary pressures and supply chain issues

- Lower population growth

- More geopolitical uncertainty

The following brief provides an overview of some major trends and issues Governors will be facing in the years to come that are either resulting from the pandemic or the impact of post-pandemic economic recovery and growth—several of which were discussed during an NGA-hosted bipartisan meeting of ten Governors that took place in Denver, Colorado in August 2021. This brief also provides examples of actions Governors and states are taking to address these issues.

Ongoing Health Effects

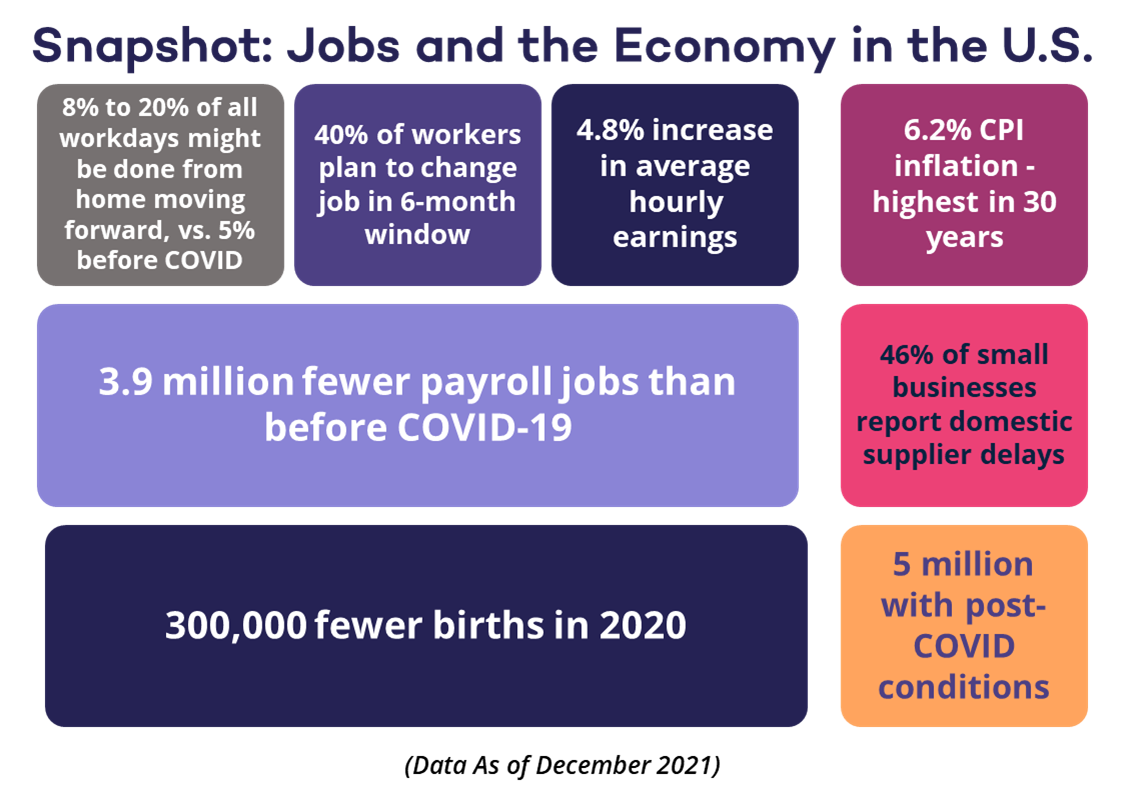

While deaths represent the most destructive aspect of COVID-19, many more Americans are surviving but are likely to suffer longer-term post-COVID conditions. Epidemiologists estimate that roughly 10 percent of all cases may experience post-COVID conditions, meaning there could be 5 million such cases so far. Post-COVID conditions are considered a disability under the American with Disabilities Act as of July 2021 and many with these conditions will require additional medical care. Already, medical care clinics for patients experiencing post-COVID conditions are appearing in many locations; pharmaceutical companies are telling their investors they expect additional future demand for their goods and services due to ongoing effects; and some economists are marking up their estimates of healthcare as a share of the U.S. economy in the coming years.

It is also important to note that the pandemic exacerbated pre-existing health disparities as well as disparities in demographics experiencing homelessness or unemployment. Increasingly, rural areas are outpacing the rest of the nation in COVID-19 positivity and morbidity rates. In addition to continuing to increase vaccine uptake and addressing immediate health care needs, addressing socioeconomic determinants of health for racial minorities, rural residents, Native populations, and other underserved communities will be important for future prevention, for mitigating the effects of post-COVID conditions among these populations, and for supporting economic recovery.

Issues Facing Governors:

- Are states prepared for greater spending on medical coverage for Medicaid patients?

- Do states need to devote more resources on recruiting and training their healthcare workforces?

- How might each state address increased demand among COVID long-haulers for workplace accommodations and/or new jobs?

- How might states address the increased need for treatment for substance use disorders and mental health concerns that is already apparent in many parts of the country?

What States are Doing:

Governors are engaging state agency, education, and health care sector partners to grow and retain the direct care workforce in their states by standardizing and streamlining roles and regulatory requirements for direct care worker positions across state agencies; developing intentional recruitment and training strategies; creating platforms for cross-sector collaboration to develop and deliver programs; and tackling wage issues that deter participation in direct care occupations. Read more here.

- The Colorado Long-Term Direct Care Workforce Workgroup is an executive branch initiative led by Lieutenant Governor Dianne Primavera established in 2019 to convene and coordinate state-level conversations regarding direct care workforce challenges. The workgroup consists of three Action Groups focused on the challenges the Workgroup identified as priorities: Compensation & Benefits, Training & Career Advancement, and Value & Awareness.

Several states are developing career pathways for the direct care workforce that are centered around work-based learning and apprenticeship opportunities.

- A 2017 study commissioned by the Indiana Governor’s Health Workforce Council, Certified Nurse Aide (CNA) as a Pathway to Licensed and Professional Nursing (LPN) in Indiana, informed steps taken by community colleges in the state to develop bridge programs that aim to reduce cost barriers and enhance LPN career pathways for current CNAs. These bridge programs continue to benefit career pathway participation as the pandemic increases workforce needs.

- Missouri Apprentice Connect identifies in-demand occupations such as CNAs and matches prospective workers with apprenticeship programs where they can earn wages while receiving training and work experience. Read more here.

Many Governors are also focused on ensuring that both near- and long-term health effects of COVID-19 are addressed in an equitable way.

- The Alaska Department of Health and Social Services and the Alaska Native Tribal Health Consortium established the Alaska Vaccine Task Force to embed tribal and state coordination into all aspects of the COVID-19 vaccination process including allocation, distribution, communication and funding. The taskforce was co-led by state and tribal leaders, all decisions were shared, and full transparency was prioritized. This approach enabled strengthened trust between the state and tribal leaders on an issue that has current and historical ramifications (read more here). Other states have also established health equity or vaccine equity task forces and work groups, including Illinois, New York, Vermont and Virginia. These approaches can be used by Governors and states to inform planning around service provision and resource allocation for addressing the effects of long-haul COVID, as well.

Difficulties (Re)Building Workforces in Key Sectors

Surging layoffs in the early months of the pandemic, a large-scale shift to remote work for about half the U.S. labor force, fluctuations in rehiring patterns, and other individual work and lifestyle changes have fundamentally altered the U.S. labor market. Factors impacting the pace of the return to work include about two million more retirements than expected during 2020; continuing workplace safety concerns; difficulties arranging child care; federal unemployment benefits that in some cases boosted total unemployment compensation to equivalent or superior compensation to full-time work; and higher-than-usual quit rates as more workers reconsider their options.

The National Federation of Independent Businesses (NFIB) reports that nearly 50 percent of small businesses have at least one unfilled opening, while close to 60 percent say they have “few” or “no” qualified job applicants for open positions.

Manufacturing and leisure & hospitality have been particularly hard hit. According to Opportunity Insight’s online dashboard, while overall job postings at the start of November were roughly in line with pre-pandemic levels, postings for manufacturing and leisure & hospitality jobs were respectively 10 and 6 percent higher than pre-pandemic levels.

With schools having broadly re-opened this fall and federal supplemental benefits having ended on September 6, a pickup in rehiring is likely in the coming months. However, substantial re-sorting in the workforce is likely to continue in coming months and years. For example, a recent survey of 30,000 workers found that 40 percent were planning to change jobs in the next six months, and a record-breaking 4.4 million people quit their jobs in the single month of September 2021. Businesses continue to report difficulty finding the workers they need, with small businesses bearing the brunt of labor supply challenges.

Together, these shifts and the widening perception of a skills mismatch will need to be addressed through creative solutions and new investments by employers, governments and workers. Employers will need to increase investments in hiring, training and upskilling, as well as in automation. The nature of work is also likely to evolve, with more businesses offering hybrid work options and more favorable terms for workers (more full-time work, fewer split shifts, more regular hours, more guaranteed time off, etc.). Governments will be challenged to offer more sophisticated skill-matching services, better training, and better coordinated services, such as easier access to necessary housing or nutrition support and smoother public transportation options for workers. And workers will need to take advantage of opportunities, such as workplace training, certification programs, and other skill-building programs, to continue to progress up the wage scale over time.

Issues Facing Governors:

- Which targeted strategies can reach workers who have left the labor force, especially parents of school-age children, women of color, and other demographic groups that have suffered relatively high large declines in labor force participation during COVID-19?

- How to further the development of clear career pathways—and reduce barriers to entry—for in-demand occupations such as energy, infrastructure, transportation and logistics, manufacturing and health care?

- What steps will advance the development of digital skills across all age groups, as well as critical thinking and other skills that complement more advanced workplace technologies?

What States are Doing:

Several states are dedicating significant federal and state resources to aid workers and businesses most impacted by the pandemic, with a focus on equity and on sectors with urgent and growing workforce needs, including advanced manufacturing, construction, IT, health care, hospitality and tourism, AI and robotics, and clean energy.

- Wisconsin Governor Tony Evers dedicated $130 million in ARPA funds to support key programs administered by the Wisconsin Economic Development Council, Department of Workforce Development, and Department of Administration, including funding for subsidized employment and training for unemployed individuals, and funding for career coaches to connect job seekers returning to the workforce with employment and training opportunities. Gov. Evers also dedicated $140 million to a grant program to support businesses in tourism and entertainment, which are among the state’s largest and hardest-hit industries.

Many states are also improving coordinated service delivery across employment services, training and work supports administered by the state and improving outreach to vulnerable populations. For example, the first ten state grantees of the NGA Workforce Innovation Network—Alabama, Arizona, Colorado, Hawai‘i, Illinois, Maine, Missouri, Nevada, New Mexico and Washington—are among the states that have taken a variety of approaches to this.

Related to improving coordinated service delivery and facilitating connections to work and training, states are also innovating with new tools to help individuals, educators and career navigators identify the most appropriate career pathways and job matches.

- Governor Kay Ivey’s Alabama Workforce Council launched the Dashboard for Alabamians to Visualize Income Determinations, a career planning tool that includes a benefits cliff calculator to help individuals understand which career pathways will help them achieve self-sufficiency and overcome potential loss of public assistance. This empowers users with the information necessary to make career decisions while maintaining financial security.

Increase in Remote Work

While future work patterns are still in flux, it is likely that an increased portion of workers will permanently work from outside large metropolitan areas in remote or hybrid work arrangements. In fact, some experts estimate that between 8 and 20 percent of workdays will be supplied from home after the pandemic ends, compared with 5 percent before the pandemic.

Some have speculated that hybrid work patterns, such as 3-4 days a week of in office work, may lead more workers to choose suburban or exurban living locations. This would have implications for the distribution of job and revenue growth, housing prices, business development, demand for inner-city transportation networks (including public transportation), and train and auto infrastructure for commuters between rural or suburban and urban areas. For example, one recent study suggests that post-pandemic remote work will directly reduce spending in major city centers by 5-10 percent compared to pre-COVID-19 levels.

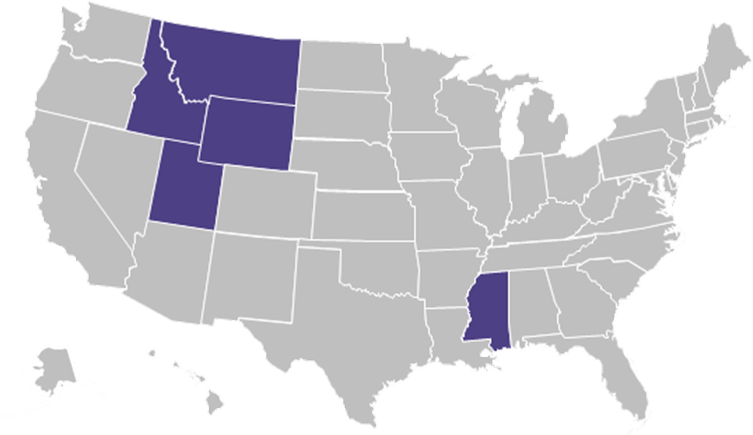

Regions may experience markedly different results from these shifts. The U.S. cities with the largest increases in population from 2010 to 2019 (Phoenix, Houston, San Antonio, Los Angeles, Austin, Fort Worth, and New York, according to the Census Bureau) may see their growth from the last decade dissipate if individuals and families increasingly choose more remote locations in surrounding areas. Meanwhile, suburbs and smaller cities are likely to benefit – a possibility supported by recent analysis of data from the U.S. Postal Service. Already, new “bedroom communities” are popping up in previously rural or non-residential areas outside San Francisco, Minneapolis, and other large cities as some workers who may commute only 2-3 days a week choose to live farther from city centers. Meanwhile, some less populated states have experienced an influx of white-collar remote workers (see Figure 1).

Issues Facing Governors:

- Is infrastructure (including transportation, housing and broadband) sufficient to support new workers in rural and suburban areas?

- Are current businesses in major urban centers sustainable? What kinds of support, either to adjust business or operating models or to ease the hardship of closure, might the state offer?

- How might remote work trends effect state and local tax revenues—both for states or regions losing workers and states gaining workers?

- Are there opportunities for re-marketing of personal and business tourism to appeal to more mobile individuals (while also boosting tourism and hospitality industries)?

What States are Doing:

Several states are attracting remote workers with incentives to relocate to their state, including financial reimbursement for relocation costs or income tax reciprocity agreements to facilitate remote work across state lines.

- In August 2021, Vermont updated their Remote Worker Grant Program established in 2018. Through this program, the state’s Agency for Commerce and Community Development administers grants to incentivize out-of-state remote workers who are able to relocate to make the move to Vermont. As part of its update, the state reimbursement will provide approved applicants with grants of up to $7,500 for workers who move to Vermont after July 1, 2021.

- Virginia has income tax reciprocity agreements with Kentucky, Maryland, Pennsylvania, West Virginia and the District of Columbia to ensure that taxpayers only pay the income tax of their state (or district) of residence. Virginians who work in one of these states, either physically or remotely, only pay income taxes in Virginia. While historically these types of agreements have been especially relevant for neighboring states, others may consider this type of agreement with states across the country as more people work remotely for out-of-state employers.

- During the pandemic, Utah was able to transition more easily to fully-remote work for state employees, thanks to a 2019 pilot program that promoted remote work opportunities for state workers. The initiative was started as a way to improve air quality by limiting commuting, increase job opportunities for people in rural areas, support talent retention and recruitment efforts, increase employee productivity and reduce the use and cost of state buildings.

States are also investing in the broadband infrastructure necessary to facilitate and capitalize on the opportunities presented by an increase in remote work.

- In August 2020, Idaho Governor Brad Little announced the Idaho Department of Commerce would award $48.9 million in federal coronavirus relief funds for 102 projects across Idaho that support improved broadband infrastructure, equipment and services. This investment was intended to expand opportunities for many activities that rely on high-quality broadband access, including opportunities for remote work. The funds were targeted toward projects that serve communities of fewer than 3,000 residents and communities with limited broadband, to benefit the communities that have historically had limited digital access.

New Inflationary Pressures and Supply Chain Issues

Inflation is currently increasing at its fastest pace in 30 years and there are reasons to believe that it may remain at elevated levels for at least several years. Supply chain disruptions (including a well-publicized shortage of semiconductor chips and worsening labor challenges in transportation and logistics) have contributed to the sharply increasing prices for many goods, including new cars, furniture, meats, and for recreational items, like boats and bicycles. The service sector is not immune to price spikes, as many people looking to return to normal life and with pent-up demand for holiday travel are booking more airline trips, hotels, car rentals and vacation home rentals.

Eventually, supply chain disruptions will resolve—perhaps by the end of 2022. However, there is growing evidence, including from the University of Michigan and the New York Federal Reserve, that consumer inflation expectations are elevated or rising alongside uncertainty. Once higher prices become embedded in peoples’ minds in this way, inflation becomes more persistent and more likely to remain at elevated levels. Indeed, some economists worry that this process of self-reinforcing rounds of price and wage increases could become like a vicious circle, as occurred in the 1970s.

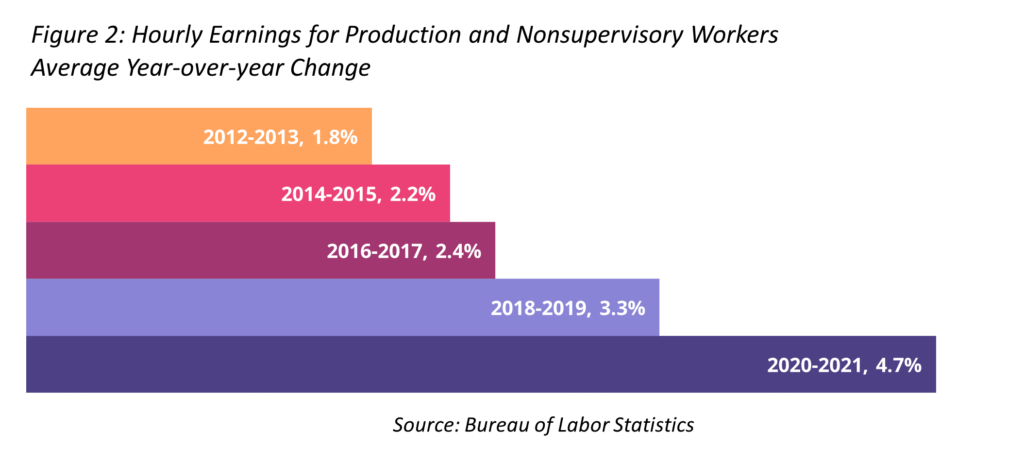

There is evidence that wages are starting to reflect inflationary pressures, especially the wages of traditionally lower-paid workers. In the past 12 months, the largest wage increases have been realized by leisure and hospitality workers (compensation up 12.4 percent), education and healthcare workers (5.7 percent), retail trade workers (4.4 percent), and durable goods manufacturing workers (3.8 percent). While these gains may be beneficial to lower-income workers in the short run, sustained large gains could trigger ongoing cycles of wage increases and inflation more broadly, which could erode nominal gains in wages. Already, many firms that are increasing salaries for their entry-level workers to $15 an hour or more are also increasing wages for workers on higher rungs of their pay ladders in order to maintain company compensation differentials. This combination of higher wages and rising inflation expectations seems likely to keep inflation notably above the 1-2 percent range prevalent over the past decade.

Issues Facing Governors:

- What state budget modifications might be necessary to fund more expensive labor across government functions, as well as procurement of more expensive goods and services?

- How will higher inflation assumptions affect estimates of future revenue from income, sales, and property taxes? And are likely timing effects being taken into account? For example, housing prices are jumping rapidly, but typical real estate reappraisal cycles can take several years to translate into higher tax revenues.

- Which state agency business supports and workforce investments will help address supply chain weaknesses and other inflationary forces?

What States are Doing:

States are supporting short-term training programs that connect job seekers with well-paying jobs in occupations that fill critical supply chain needs, such as semiconductor manufacturing and transportation and logistics.

- Arizona Governor Doug Ducey has led the Arizona Commerce Authority, state workforce board, and postsecondary institutions to attract companies including Intel and TSCM to the state and to develop partnerships that deliver specialized training programs to fill the hundreds of new jobs being created by semiconductor manufacturing facilities being built in the state.

- Delaware Governor John Carney launched Forward Delaware in August 2020 with a $15.3 million CARES Act allocation to the state. Forward Delaware is a training initiative designed to help at least 1,200 workers laid off during the pandemic find new career opportunities in key sectors that impact broader supply chain networks including transportation and logistics and construction.

This is just one piece of addressing higher inflation rates. Governors and state agencies will be developing strategies to account for sustained tax revenue and cost increases over the coming years as they develop state budgets and other policy.

Lower Population Growth

U.S. population growth has been in decline over the last several decades due to a number of factors, and COVID-19 appears to have accelerated this trend, at least in the short term. First, COVID-19 is a public health crisis that has resulted in the death of more than 787,000 Americans. The pandemic also has disrupted personal decisions to get married, form households, and have children. Researchers and government sources estimate that COVID-19 caused roughly 5-10 percent fewer births in 2020 than otherwise would have been expected (a decline of 150,000-300,000 births below normal levels), and early evidence suggests that births in 2021 may be down by 15 percent or more from normal levels. In fact, in 2020, 25 states reported more deaths than births, and it is unlikely that there will be a significant “catch up” in births in coming years—data from the Great Recession of 2008-09 shows that the shortfall of births over that period was never reversed. These birth and death trends may be even more dramatic in the twelve months of 2021, compared to the approximately nine months of 2020, as many people have continued to put off having children and as deaths from COVID are ongoing.

Whether this more rapid decline in population growth continues, or whether we revert to the longer-term trendline in declining population growth, remains to be seen. Declining population growth means that businesses that sell goods and services driven by per capita use—from food, to toothpaste, to wireless phone service, to haircuts—will have fewer customers to serve over time. All levels of government will be affected, with fewer taxpayers but likely with fewer citizens seeking public services as well. For example, states might see up to 15 percent fewer children showing up for kindergarten in public schools in 2025, while relatively high mortality rates among retirees will likely dent demand for services targeted to senior citizens (which otherwise is expected to increase because of continued high numbers of Baby Boomer retirements). In addition, states that already have low annual population growth, including many states in the Midwest, may continue to struggle to meet employer needs and to attract new workers and businesses.

Issues Facing Governors:

- What strategies could allow for more flexibility in service delivery based on demand for elder care, schooling, and childcare?

- Do assumptions regarding the state’s taxpayer base and future revenues take into account current demographic trends?

- How might each state’s labor supply and economic development activities be affected?

- What are the implications for state or national policy priorities around immigration?

What States are Doing:

Governors continue to prioritize efforts to expand access to opportunity for frequently overlooked worker talent, such as people who have disabilities, are experiencing long-term unemployment, or are involved with the criminal justice system.

- New Jersey Career Pathway Partnership for Employment Accessibility, a multi-agency collaborative, coordinates program recruitment and outreach, pre-enrollment services, benefits counseling, career pathway navigation support, and placement for internships, apprenticeships, and competitive integrated employment for people with disabilities. The partnership is increasing public sector employer participation in New Jersey’s State as a Model Employer effort and is increasing employer engagement with regional colleges as part of this effort. Read more here.

- Arizona Governor Doug Ducey has supported a partnership between the Arizona Department of Economic Security and the Arizona Department of Corrections to provide Second Chance Centers in state prisons to offer employment readiness and placement services to inmates approaching release. The state also provides post-release employment services in parole centers, reentry centers, and the workforce system’s career centers throughout the state.

Governors and states may also consider other ways to address longer-term workforce shortages, particularly in areas where bringing more current residents into the labor force as suggested above will not sufficiently fill business needs or support continued economic growth. To this end, this need is likely to inform governors’ state and national immigration policy positions.

More Geopolitical Uncertainty

COVID-19 also has accelerated the rise of global geopolitical tensions. One particular consequence has been an erosion in economic and geopolitical relations between the U.S. and China. Disagreements about everything from the source of the COVID-19 outbreak, to concerns about China’s more authoritarian political stance (including its stances toward Hong Kong and Taiwan), have worsened relations. As the two countries have come to view each other more as strategic competitors, both have become more skeptical of foreign direct investment from each other – and from other countries, quicker to ban exports of items like critical technology, and faster to use regulatory and administrative measures to make it more difficult to do business in the other country. Meanwhile, U.S. national policy has moved in the direction of shortening supply lines and promoting more domestic sources of semiconductors, rare earth minerals, and other critical materials for electric vehicles, batteries, solar panels, etc.

This dynamic is likely to result in fewer business deals between the two countries over the next few years, fewer trade missions between the two countries, fewer Chinese tourists coming to America, and less Chinese interest in buying U.S. real estate. There may, however, be opportunities for states to attract more reshoring investments as industries shift to more domestic manufacturing.

Issues Facing Governors:

- Might states shift from a focus on U.S.-China foreign direct investment and trade to more trade and investment deals with Europe, Mexico, Canada, Japan, Korea, India and other trade partners? How will states adjust to a business environment that will likely include less foreign direct investment overall?

- How will states be impacted by semi-permanent reductions in international visitors, including from China—especially to destinations like San Francisco, Los Angeles, New York, and Florida?

- Will a substantial decline in foreign and Chinese immigrants mean a decline in demand for U.S. real estate and lower home prices in key markets?

What States are Doing:

Governors are leaders in building beneficial trade relationships with foreign nations, either directly on behalf of their state or indirectly by supporting in-state businesses to build relationships.

- In 2019, Arkansas Governor Asa Hutchinson travelled to India to meet with the leaders of 10 companies who were considering investments in the U.S. He encouraged them to invest and manufacture products in Arkansas, citing the state’s appropriately skilled workforce, central location, easy access to waterways and interstates, and quality of life. On this trip he also signed a Mutual Cooperation Agreement with the Indo-American Chamber of Commerce to encourage investment between private sector businesses and Arkansas.

- In July 2021, Virginia Governor Ralph Northam announced that eight companies across the Commonwealth recently graduated from the Virginia Economic Development Partnership’s Virginia Leaders in Export Trade program. The program is a two-year international business acceleration program that provides international sales plan development support and a range of other services and connections to potential international trading partners. At least 378 Virginia companies have participated in the program since its inception in 2002.

Governors and states are also leveraging opportunities to reshore industry, particularly in manufacturing and production.

- The Nevada Governor’s Office of Economic Development’s Plan for Recovery and Resilience prioritizes reshoring production to the United States to advance the nascent advanced manufacturing sector in the state. In April 2021, Governor Steve Sisolak joined College of Southern Nevada officials and local business leaders in dedicating an investment of nearly $2 million to establish a new advanced manufacturing rapid response program in the state, which will increase opportunities for local manufacturers to train and recruit local talent that will help fill their current needs and attract new businesses.

- In August 2020, the Ohio Development Services Agency awarded $20 million in grants to 68 Ohio manufacturers to produce personal protective equipment and help ensure the safety of Ohioans during the coronavirus pandemic. The grants provided through the Ohio PPE Retooling and Reshoring Grant Program provided an opportunity to create new businesses while ensuring the state had sufficient personal protective equipment reserves during the pandemic.

Conclusion

COVID-19 will have long-tail effects that continue to change the U.S. economy and present challenges to states. Governors are aware of some of these major shifts and are incorporating changes into their planning processes. Key challenges will likely include dealing with new and varying health costs, a much-changed labor market, worsened demographics, higher inflation, and fewer China-focused business opportunities. Governors are learning and working together to address these issues, as well as many of today’s other pressing public policy challenges. The NGA Center for Best Practices supports this collaboration and solution development as the nation’s only consulting and research firm dedicated to supporting Governors and their executive appointees. The NGA Center policy teams provide Governors’ offices and state executives with best practice research, facilitated peer learning, and customized support across a number of policy areas, including on the issues discussed in this brief.

Prepared by Rachael Stephens, National Governors Association, and Robert Wescott, Keybridge Research. Some views expressed in this paper are based on the authors’ professional judgments and experience. Stephens has over 10 years of experience in workforce and economic development, including as a workforce development program manager and as an economic policy researcher. She is the Program Director for Workforce Development & Economic Policy at NGA, the nonpartisan membership organization of the nation’s governors. A more detailed biography is available here. Wescott has over 35 years of experience as a professional economist, including as a White House economic adviser and as an official at the International Monetary Fund. He is the founder and president of Keybridge Research, a Washington, DC-based economics and public policy consulting firm. A more detailed biography is available here. Additional support provided by Tim Blute of NGA and Julie Coen of Keybridge.