Executive Summary

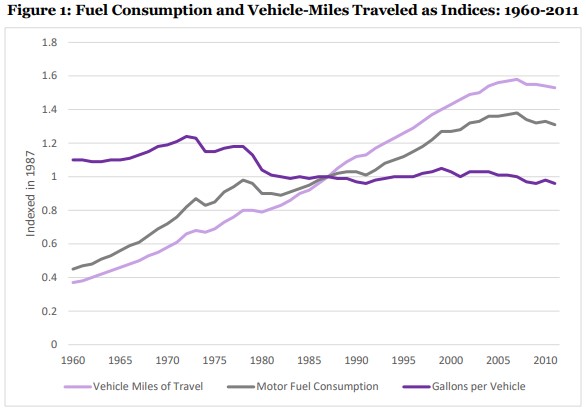

States face a grave transportation funding situation: Revenues are not keeping pace with needs as vital infrastructure assets reach the end of their designed life cycle and populations grow and shift. The funding gap is significant. According to an estimate from the American Society of Civil Engineers, $1.4 trillion in additional funding is required to meet the country’s infrastructure needs by 2025, and that gap is growing. At current funding levels, the gap will rise to $4.3 trillion by 2040. Traditionally, states have relied on a variety of revenue sources for transportation funding under a “user pays, user benefits” principle that roughly approximates a “user fee” to at least some degree. These sources include vehicle registration fees, tolls and state and federal gas and diesel taxes, also known as “motor fuel taxes,” which represent the largest portion of revenue, ranging from 29% to 60% of state revenue. Fees and tolls are often regularly adjusted, and 31 states have increased their motor fuel taxes in the past six years, but a combination of factors has diminished the value of motor fuel taxes over time. Such factors include the rising fuel efficiency of vehicles, a shifting federal-state cost share on infrastructure investments and inflation (for taxes that are not indexed, which includes the federal motor fuel taxes that has remained at the same price since 1993 and 33 state taxes). Across all levels of government, the proportion of user-fee funding for highways has fallen over time. In 1965, user revenue accounted nearly 75% of spending, as of 2012, it has fallen to under 50%.

As states are facing these challenges, the transportation sector is moving toward greater electrification. This shift is occurring as the technology improves, consumer appeal increases and states and others support greater electric vehicle (EV) use stemming from benefits for: economic development, sustainability, cost savings, health outcomes, air quality, climate change and fuel security. The move also spans multiple fleets, including personal, private and government-owned light-duty, transit and medium- and heavy-duty vehicles.

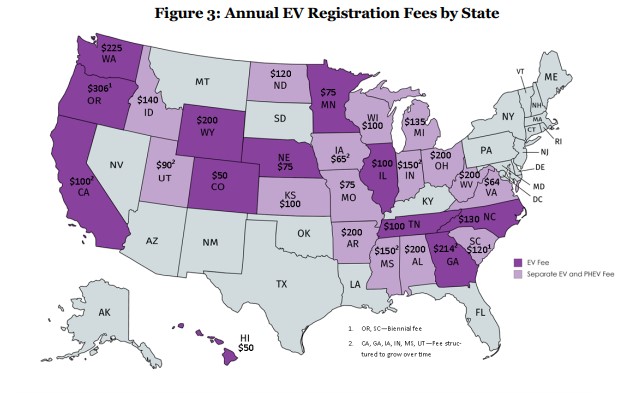

The growing popularity of EVs is adding to states’ concerns about transportation funding. Vehicle electrification will ultimately lessen a mainstay of traditional sources of funding for the transportation system: motor fuel taxes. However, EVs currently make up less than 1% of the nation’s total fleet and only 2% of new sales across the United States. Even in states with the highest EV adoption — California, Oregon, and Washington — EV sales make up less than 8% of all new vehicle sales. EVs are expected to grow in popularity, although estimates vary. The Edison Electric Institute (EEI) projects that EVs could account for 7% of the total light-duty fleet in the United States by 2030, or 18.7 million of the projected 259 million light-duty vehicles on the road. Concern with this growth, while not yet a reality, coupled with concern about the larger transportation funding shortfall, has prompted more than half of states to introduce an additional annual registration fee on EVs, ranging from $50 to $225 per year.

Many have raised concerns about the adoption of EV registration fees and question the role of EVs in the transportation funding crisis. A first-order concern is that EV registration fees do not currently make a significant contribution to the goal of supporting transportation revenue, and in fact, they may adversely affect the goal of advancing EV adoption, particularly because the fees are annually paid all at once, up front. A nationwide survey by the University of California Institute of Transportation Studies (UC ITS) found that even a $100 annual EV registration fee reduced consumers’ likelihood of purchasing a battery-powered EV by 11%; it reduced their likelihood of purchasing a plug-in hybrid by 18%. Notably, in conversations with the Oregon Department of Transportation, officials suggested that their analysis of new vehicle sales found that consumers were insensitive to registration and title fee changes. A related problem is that annual, upfront registration fees disproportionately affect lower-income vehicle purchasers in contrast with motor fuel taxes, which are paid incrementally at the pump. Further, there are overarching concerns that any imposition of an EV fee will increase overall costs and therefore weaken adoption incentives and the implicit cost drivers that encourage higher fuel efficiency. Some states have balanced these concerns by developing plans to only adopt EV-specific fees when the share of EVs reach a certain level within the overall fleet.

A second area of concern is that some view the fee amounts adopted in some states as greater than the equivalent amount of taxes paid by similar gasoline-fueled vehicles. Thus, fees are seen as creating an inequitable approach to maintaining the road network. Consumer Reports has issued the most comprehensive version of such an analysis, in which the authors determined that of the 28 states that charge an extra registration fee for EVs, 11 have set the fee higher than the equivalent gasoline taxes that new car owners pay. The issue of equivalency is complex, including which metrics should be used to determine the “equivalent” of gasoline taxes, because of the rising and varied nature of fuel efficiency between the average vehicle in the fleet compared with new vehicles, making it an issue that states must examine carefully. The Consumer Reports analysis set a metric for EV fees as “justifiable” if it provides the same highway funding revenue as the average new gasoline vehicle. Further complicating matters, the user-pay model embodied by motor fuel taxes does not provide for a simple one-to-one comparison. The added wear and tear on the transportation system attributable to each light-duty passenger vehicle is low because most roads are designed and built to withstand the significantly higher weight of freight vehicles. This is the case even for EVs, which are slightly heavier than other light-duty vehicles. In principle, each user is expected to contribute to use the road, but the physical impact on the roadway is generally not proportionally considered.

These dynamics presents a dilemma for decision makers who want to advance policy goals to support transportation electrification and meet transportation funding needs. This dilemma is particularly pronounced in the 28 states that have an extra EV registration fee. Of those states, eight also have a goal for EV adoption, and they and others have EV tax incentives, outreach programs or other adoption efforts in place. At the state level, this dilemma plays out in executive and legislative branch priorities; the most pronounced example being state departments of transportation that may have a directive specifically on reducing emissions, while simultaneously maintaining existing systems and achieving longstanding transportation missions of service delivery and performance. The role of revenue sources directly drives and shapes many of these decisions. Governors can help meet these two distinct yet interconnected goals by considering the broad range of existing and emerging policy options available and by collaborating across state agencies and stakeholders to craft solutions.

The developments and concerns surrounding EVs have prompted a broader consideration of how states are approaching their transportation revenue needs, and the various incentives and disincentives that are associated with each potential revenue source. Efforts to explore alternative approaches have centered on how best to reflect the user-pays principle. These efforts are driving an examination of how states, including those that are debating to retain or adopt an EV fee, can dampen these areas of concern. Some measures that states are adopting or considering include:

- • Increasing existing motor fuel tax rates.

- • Indexing motor fuels to inflation.

- • Implementing mileage-based user fees (MBUFs), also known as “road usage charges” (RUCs).

- • Studying fuel-neutral fees, based on energy consumption.

This paper examines a variety of funding methods in an era of increased electrification of the transportation sector. In addition, it highlights best practices from across the country. As policymakers look to the 2020 legislative session and weigh decisions about current and future sources of transportation revenue, governors can consider these measures to help their state better plan for a robust, sustainable and equitable approach to transportation revenue. Such efforts help ensure that transportation revenue sources and the mechanisms implemented for collection align with broader state policy goals. This document is intended to help states develop a comprehensive approach for addressing long-term transportation infrastructure needs that avoids dampening EV sales while simultaneously encouraging EV adoption through other programs and incentives.